Statement Problem

Although the profit in California Pizza Kitchen (CPK) expanded to over 6miilion dollars in 2007, the recent 10% share price declined during the month of June 2007. CPK ponders if it would be an ideal time to repurchase shares and potentially leverage the company`s balance sheet with borrowings available on their existing line of credit.

Analysis of Problem

A company`s reasonable and proportional use of debt and equity to support its asset is a key indicator of balance sheet strength. A healthy capital structure that reflects a low level of debt and a corresponding high level of equity is a very positive sign of investment quality. California Pizza Kitchen (CPK) currently doesn`t have any debt. The company only operates their equity. CPK needs to adjust their cost of capital because a proper debt ratio can obtain tax deduction. Debt financing can decrease tax cost because interest cost decrease tax cost. The more debt ratio increases, the more tax costs decrease. CPK have to find the minimized WACC and the maximize value of company. Weight average cost of capital (WACC) is used as discounted rate applied to future cash flows for deriving a business`s net present value. Through finding the minimized WACC in debt financing, CPK can find their best value of company.

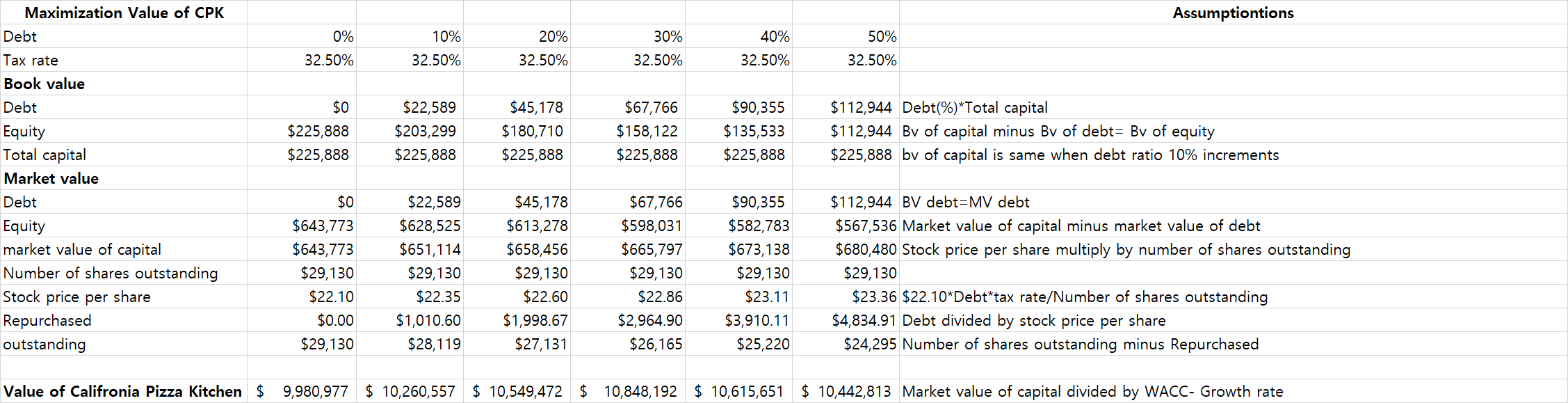

In order to find minimized WACC in leverage on cost of capital, many variations are needed. First of all, the unlevered beta of CPK is 0.85 in Exhibit7. The unlevered beta is the beta of a company without any debt. We have to calculate the levered beta using the unlevered beta. The corporate tax rate of 32.5% was used to calculate the levered beta by adjusting the ratio of debt and equity. The debt ratio was adjusted from 0% to 50%. When the debt ratio is 10% to 50% at 10% increments, the levered beta is 0.94, 1.06, 1.21, 1.42 and 1.70, respectively.

Next, Capital Asset Pricing Model (CAPM) is needed to calculate the WACC. Risk free rate is 5.2% in U.S treasury securities because the 30-year bond rating is more profit able than 10-year bond rating of 5.10%. According to S&P 500, market risk premium is 5%. In the end, the cost of equity is 9.92%, 10.51%, 11.27%, 12.28% and 13.70% when each debt ratio is assumed from 10% to 50%. Cost of debt is 6.16% from 10% to 30%. When debt ratio is 40% and 50%, the cost of debt can be assumed by other comparable companies in the restaurant industry. According to Moody`s, Darden Restaurants Inc. has Baa corporate bonds. The bond rating is 6.7% in June 2007 so CPK has to be higher than 6.7%. The cost of debt is 7.3% and 7.9% when each debt ratio is 40% and 50%, respectively. Through the variations, the WACC is calculated at 9.35%, 9.24%, 9.14%, 9.34% and 9.52%. Minimized WACC is 9.14% when debt ratio is 30%. In the end, CPK has to adjust the debt ratio from 0% to 30%.

In order to find the maximized value of CPK, market value of capital is needed because through this value, maximized value cab be found. First of all, market value of debt is equal to book value of debt. In order to calculate market value of capital, price per share is needed. Through a calculation, when the debt ratio is 10% to 50% at 10% increments, price per share is $22.35, $22.60, $22.86, $23.11 and $23.36 Price per share continuously increases because tax shield effect is generated. When debt ratio increases, the tax shield effect also increases.

However, increasing the price per share continuously is impossible in reality because increasing debt ratio actually increases debt. In the end, price per share can`t measure the maximize value of CPK. Market value of capital is equal to price per share multiplied by the current number of shares outstanding. In the end, the market value of capital also is calculated. Through the market value of capital, the value of CPK can be calculated. The value of CPK has to reflect current risk so valuation formula like a terminal value formula has to be used at market value of capital. The value of CPK is market value of capital divided by WACC minus grow rate. Growth rate is 3%. Through the calculations, the maximized value of CPK is $10,848,192 when debt ratio is 30%. In the end, CPK has to adjust the debt ratio from 0% to 30%. When the debt ratio is 30%, the WACC become minimization and the value of CPK becomes maximization.

Recommendation

California Pizza Kitchen (CPK) needs only to repurchase their stocks, and refinancing with 30% debt is enough for that purpose. When debt ratio is 30%, the CPK`s WACC is minimized, and value of the company is maximized. The minimized WACC is 9.14%, and the maximized value of CPK is $10,848,192. A repurchasing share program requires much cost. However, CPK has a lack of cash so the company requires a debt financing method. In the end, CPK has to adjust their debt ratio from 0% to 30%.

'비밀공간' 카테고리의 다른 글

| 기업분석#(Microsoft,마이크로소프트) (0) | 2020.04.08 |

|---|---|

| Teletech Corporation, 2005 (4) | 2020.04.07 |

| Flinders valves and controls Inc. (2) | 2020.04.05 |

| 디트로이트 모토쇼 관람기#2(미국유학일상) (5) | 2020.04.04 |

| 기업분석#(JetBlue Airways-2) (0) | 2020.04.04 |