Statement Problem

RSE and Flinders have both expressed interest in a merger. The problem is now to determine what Flinders is worth, and agree upon the terms for RSE to buy Flinders. In order for this to happen, RSE has to believe Flinders is worth at least as much as Flinders is willing to sell its company for.

Analysis of Problem

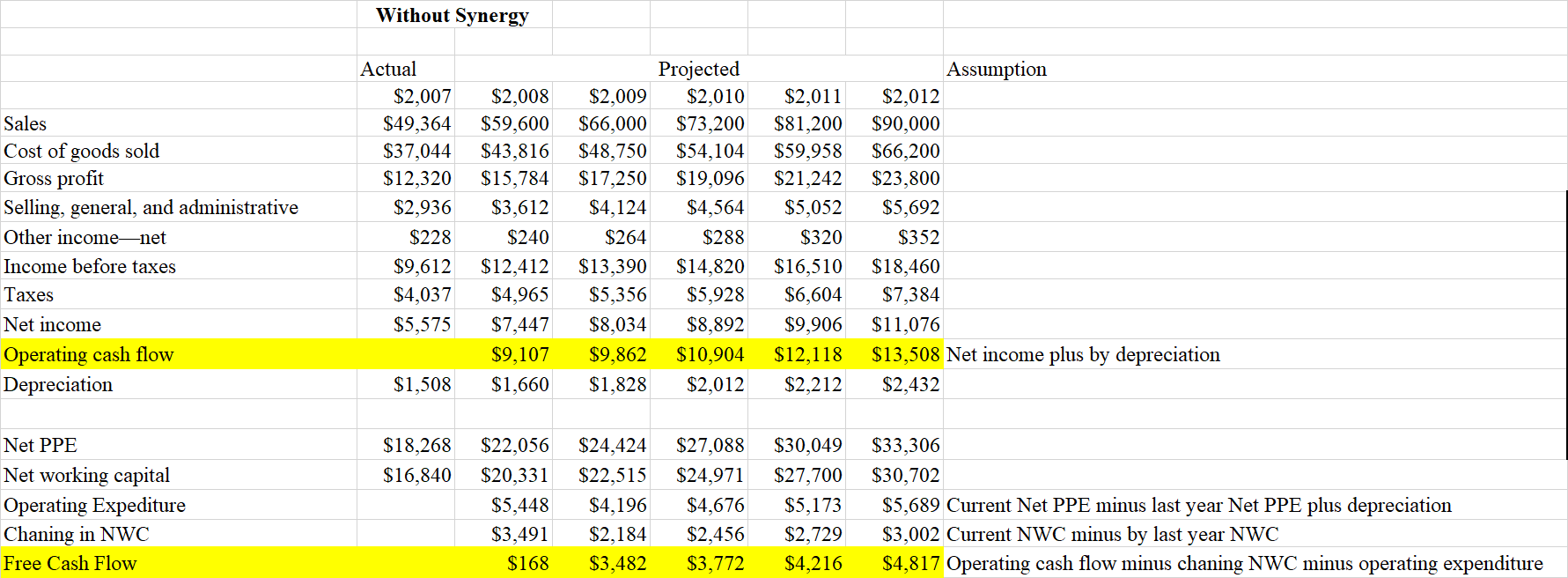

Both companies have experienced recent rapid rises in share price due to strong performance despite the weak economic environment. Currently, Flinders` common stock is $39.75. Before acquisition, Flinders` beta is 1.00 and the risk free rate used is 4.52%, which is the 30 year US Treasury Yield for April 2008. RSE and Flinder need to predict the risk market premium for 2008 to 2012. In order to find the risk market premium, they should use the geometric mean (5.50%) instead of the arithmetic mean (7.20%) because the arithmetic mean is usually used for the period under one year whereas the geometric mean is better used for the long term period. In the end, the cost of equity will be10.02%. Flinders has no debt so the cost of equity becomes the weight average cost of capital (WACC). According to Exhibit10, which is Forecast of Financial Statement for Flinders Control and Valve, Flinders` sales will increase about 11% every year. This forecast of financial statement did not include any benefits of the merger.

RSE and Flinders want to merge in order to increase their profit. However, it is difficult to determine the worth of FIinders` share price when RSE takes over Flinders. RSE and Flinders have to find the proper price per share. In order to determine Flinders` price per share when RSE takes over Flinders, many variations such as the cost of equity and growth rate have to be changed. By adjusting the values, RSE and Flinders can find the range of price per share. If RSE and Flinders merge, they can obtain synergy. If they can`t obtain synergy with each other, it is unnecessary to merge. If synergy occurs between two companies, the cost of equity increases because the beta, which is contained by the cost of equity, increases. The beta is a measure of the volatility of a security or a portfolio in comparison to the market as a whole. When two companies merge, the volatility toward market increases. In the end, the WACC increases by increasing the beta.

Based on the acquisition, Flinders` beta can be assumed at 1.10, 1.20 and 1.30. By increasing the beta, the WACC also increases. When the WACC increases, the price per share decreases. However, when synergy occurs between two companies, the sales growth increases and the cost of goods sold decreases. In the end, the disadvantage of the increased risk because of the WACC is offset through the growth rate of sales and the decline of cost of goods sold. The rate of sales growth increases and the rate of cost of goods sold decreases when synergy occurs. Flinders` growth rate of sales is assumed at 13%, 14% and 15% and the cost of goods sold` rate is at 2%, 3% and 4%.

If the beta increases from 1.00 to 1.10, the WACC will be 10.57%. At the same time, the sales growth rate will increase 13% every year and the rate of cost of goods sold will decrease 2% from the original value. The price per share will be $42.24. In contrast, if the beta is 1.2, the WACC will be 11.12%. The growth rate of sales is assumed at 14% and the rate of cost of goods sold is assumed at -3%. In the end, the price per share will be $48.59. However, if the beta is 1.30, the WACC will be 11.67%. The growth rate of sales is assumed at 15% and the rate of cost of goods sold is -4%. In the end, the price per share will be $54.14.

Above the analysis result, Flinders` risk decrease when RSE takes over Flinders. By merging, Flinders has some advantages such as sales growth and decline of cost of goods sold because Flinders has power of market through merger. In the end, the market risk of FVC decreases. When synergy happens with acquisition, the sales growth will increase from 11% to 15%. At the same time, the WACC increases because FVC`s beta increases. The reason FVC`s beta increases is to increase volatility toward market. In the end, Flinders` price per share will be from $42.24 to $54.14.

Recommendation

It is recommended that Flinders Valves and controls (FVC) merges with RSE International Corporation because positive synergy occurs when RSE takes over FVC. FVC checks over their forecast of financial statement from 2008 to 2012 when FVC merge with RSE. By merging, FVC has some advantages like sales growth and cost of goods sold decline because FVC has power of market through merger. In the end, the market risk of FVC decreases. Specifically, when synergy happens with acquisition, the sales growth will increase from 11% to 15%. At the same time, the WACC increases because FVC`s beta increases. The reason FVC`s beta increases is to increase volatility toward market. In the end, FVC`s price per share predicts from $42.24 to $54.14. In the end, RSE should take over FVC to obtain synergy.

'비밀공간' 카테고리의 다른 글

| Teletech Corporation, 2005 (4) | 2020.04.07 |

|---|---|

| California Pizza Kitchen, CPK (1) | 2020.04.06 |

| 디트로이트 모토쇼 관람기#2(미국유학일상) (5) | 2020.04.04 |

| 기업분석#(JetBlue Airways-2) (0) | 2020.04.04 |

| Detroit 디트로이트 모토쇼 관람기#1 (미국유학생활) (4) | 2020.04.03 |